The overseas wealth of several relatives of senior Chinese leaders has come to light in an International Consortium of Investigative Journalists (ICIJ) report, part of the analysis by a group of media outlets of more than 11 million documents leaked from the Panamanian law firm Mossack Fonseca being called the Panama Papers. According to the report, the family members of eight current or former members of the Politburo Standing Committee of the Chinese Communist Party, including a brother-in-law of President Xi Jinping, have had “secret offshore companies.” Several prominent Chinese businesspeople were also named in the report. —The Editors

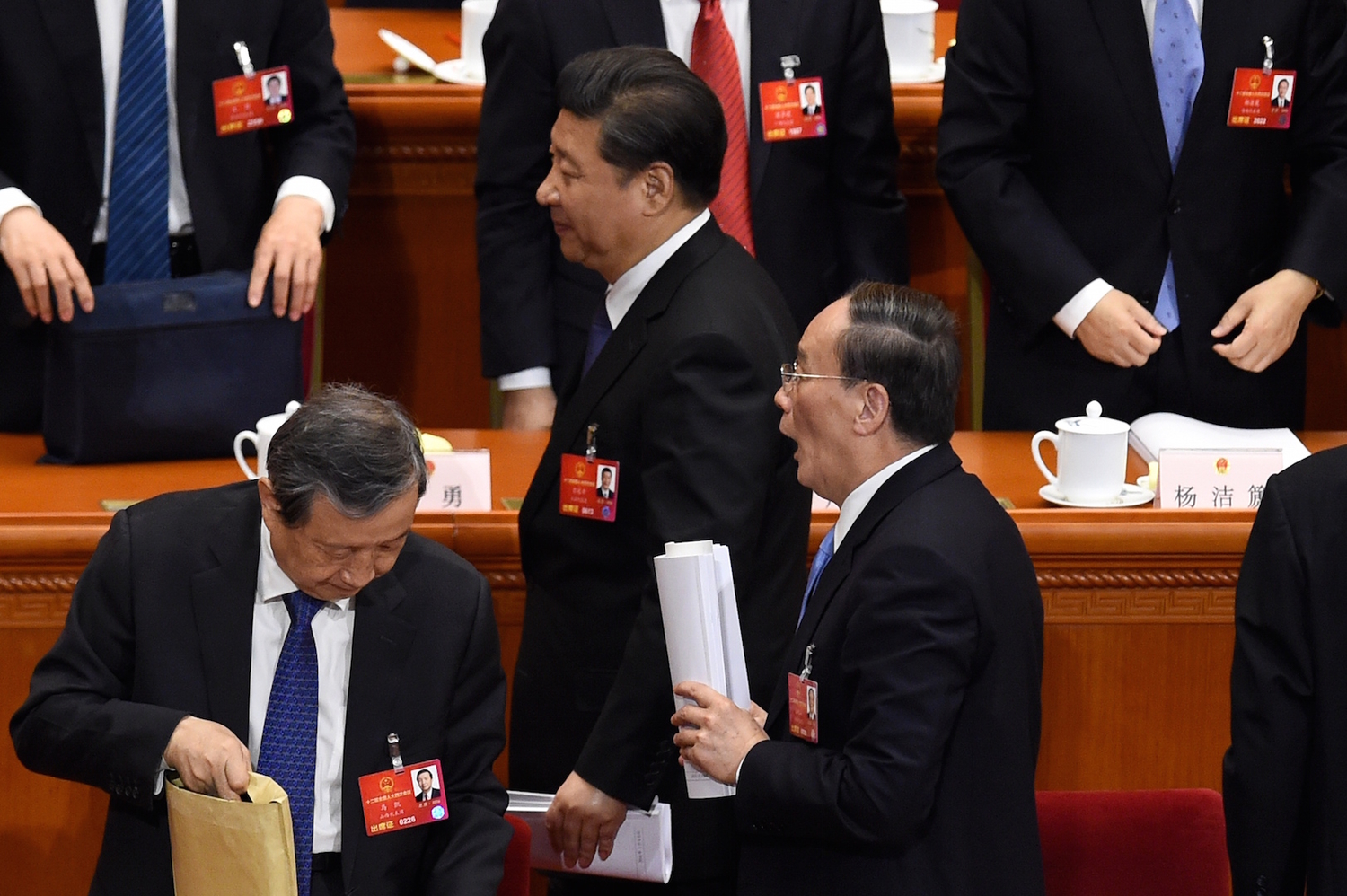

Wang Zhao—AFP/Getty Images

Chinese President Xi Jinping (center) and Wang Qishan (right), a member of the Standing Committee of the Political Bureau of the Chinese Communist Party (C.C.P.) Central Committee and Secretary of the C.C.P. Central Commission for Discipline Inspection (CCDI), leave after the opening ceremony of the National People’s Congress at the Great Hall of the People in Beijing, March 5, 2016.

Comments

Andrew J. Nathan

China’s guanxi economy comes into sharper focus step by step. We knew about Xi Jinping’s wealthy brother-in-law from Michael Forsythe’s reporting for Bloomberg; and about the wealth amassed by descendants of the P.R.C. founders from a team Bloomberg report; and about the wealthy wife of former Chinese premier Wen Jiabao from a report by David Barboza in The New York Times. The Panama Papers add more names to the list and give us new information about how the Red Aristocracy plays its money games, while still leaving a lot of questions unanswered.

We can see more clearly that smart officials do not take the money themselves. Those who did, like former security chief Zhou Yongkang and former military leader Xu Caihou, have been falling victim to Xi Jinping’s anti-corruption campaign. But it seems to be okay under Beijing’s rules of the game for a high official’s relatives to get rich. By that standard, Xi Jinping is deemed to be clean. We don’t know whether some of these relatives made their money by hard work and smart thinking. But the more cases were learn about, the harder it is to believe that this is usually the case. We need to learn more about what must be the numerous ways in which access produces money. The furtive behavior revealed in these documents suggests that even when such behavior is legal, it is still considered shameful.

As well, the Panama Papers tell us more about the one-foot-in, one-foot-out strategies of politically connected Chinese families. With their connections, they should be able to earn much higher rates of return in the go-go parts of China’s economy than in the strait-laced West, but still they send relatives and assets overseas. They don’t feel secure at home, but what exactly do they fear? Is it political strife within the regime, or the fragility of the regime itself?

When corruption started to sprout in China in the early 1980s, Deng Xiaoping defended his policy of opening to the West by saying, “If you open the window, some flies will get in.” Today it is hard to blame Chinese corruption on Western influence. The behavior revealed in these papers is the structural product of the Chinese system of power concentration and information control.

Bill Bishop

The China revelations in this leak so far do not seem to contain any huge bombshells, but Beijing’s blanket censorship of the Panama Papers crudely highlights the sensitivity and perceived dangers of the current and likely future disclosures. As usual, control is paramount for the Party and the C.C.P. is determined to wage its corruption crackdown on its terms rather than allow the Party’s agenda and target list to be determined by foreign media or activists outside the Party system. So of course there is censorship, but in the background I will wager that Wang Qishan and the CCDI are trying to pore over any of the documents they can obtain to add to dossiers on senior officials and their families to find any useful information.

I would be surprised, though, if the relevant authorities in Beijing were not aware of much of what has been exposed, and probably much more that is not public. For example, Xi Jinping’s brother-in-law, Deng Jiagui, has two offshore firms exposed by this leak, but these two were dormant by the time Xi became General Secretary, consistent with the 2014 reporting of The New York Times’ Mike Forsythe that “As China’s Leader Fights Graft, His Relatives Shed Assets.” What these new documents do not tell us is what if anything was in these companies before dormancy, or whether any assets they may have held were truly “divested” or simply transferred to a trusted friend, or “white glove” (bai shoutao, 白手套), to hold behind another layer of more impenetrable corporate secrecy.

The United States tax authorities at the Internal Revenue Service should be paying attention to the disclosures related to the Chinese-controlled companies, as there is a decent chance some of the beneficial owners are U.S. citizens or green card holders. U.S. citizens (and I believe green card holders as well) are required to file an annual Form 5471 with the I.R.S. detailing their holdings. How many actually do so, and could these papers be an entry point for the U.S. government to use tax evasion to investigate some of these people?

David Wertime

While the latest findings are unlikely to surprise Chinese palace-watchers, they cement the country’s reputation as a place whose leadership, despite its Communist provenance, is both willing and able to use the levers of international finance to obfuscate asset ownership and to utilize positions of power to benefit friends and family. The results include a dizzying array of shell companies with meaningless monikers like Glory Top, Ultra Time, Keen Best, Dragon Stream, and Purple Mystery.

The names sound innocuous enough, but they hit at a serious nerve. For the first time, the April 6 report names each of the eight current and former members of China’s elite, Politburo Standing Committee (PSC) with a family member implicated in the leaked papers. The list reaches surprisingly far back into China’s history, touching even Mao Zedong, the founder of the People’s Republic of China.

It’s vanishingly unlikely the report will make major waves in China. The country’s censors have apparently been working overtime to scrub social media of damning mentions of the Panama Papers, which have already named Deng Jiagui, Li Xiaolin, and Jasmine Li, among others, as having been involved in, or having benefited from, the establishment of offshore entities. While Chinese media has reported on the Panama Papers’ existence, it has collectively said nothing about their nexus with Chinese leaders, instead focusing on how leaked documents implicate soccer star Lionel Messi.

The report states, correctly, that setting up offshore entities is not itself illegal. Neither are Chinese leaders necessarily in a position to control their family members’ behavior. But the report nevertheless shows that those close to China’s leaders abided by something other than the highest standards of transparency. It undermines the leadership’s frequent, if self-serving, invocations of patriotism. And it appears to confirm the belief, widely held among average Chinese, that those close to influential officials trade on their connections and live by a set of rules different from that of ordinary citizens.

(For more from David Wertime on this topic, read ‘New ‘Panama Papers’ Report Hits China’s Red Elite,” at Foreign Policy’s Tea Leaf Nation—The Editors).

Taisu Zhang

That the Chinese political and business elite hold large amounts of offshore assets in tax havens is, of course, unsurprising to anyone who seriously follows these things. Moreover, the leak will probably have very little social or political impact on the Mainland: By and large, the only people who will be able to follow these developments despite the censorship—highly educated, intellectually attuned urban residents—are those for whom this is already old news. In other words, the leak may lead quite a few people to say “aha, this is further evidence of crony capitalism,” but those people probably already hold such views. Few minds, if any, will be changed.

Somewhat ironically, the non-Chinese portions of the leak might end up having a more substantial impact on Chinese intellectual opinion than the Chinese portions: One fairly common reaction in some left-leaning circles has been that “Western” elites were no less implicated by the leaks than Chinese ones—and therefore that the problem is not a distinctively “Chinese” one, but rather a global one. The problem, one could easily imagine them arguing, is that the “global elite” engages in corruption and rent-seeking across the board, and that the existence of these tax havens allows for elite collusion and exploitation on a truly international level.

What would the normative implications of such an argument be? Not that “China needs to reform its political and legal institutions to establish rule of law,” but rather that “any preexisting elite-governed political structure—Chinese or Western—is untrustworthy.” At present, no one knows whether these claims will gain any real influence, but we probably haven’t seen the end of populist socialism in China quite yet.