On January 16, the Board of Governors of the Asian Infrastructure Investment Bank (AIIB) will meet in Beijing to formally launch its operations.

A symbol of China’s growing clout on the international scene, the AIIB attracted 57 founding members, despite initial efforts by the United States to raise alarms about human rights and other concerns to dissuade its allies from signing on.

The AIIB leaders have promised that the new bank will contribute positively to addressing the region’s huge infrastructure gap and operate by the highest standards.

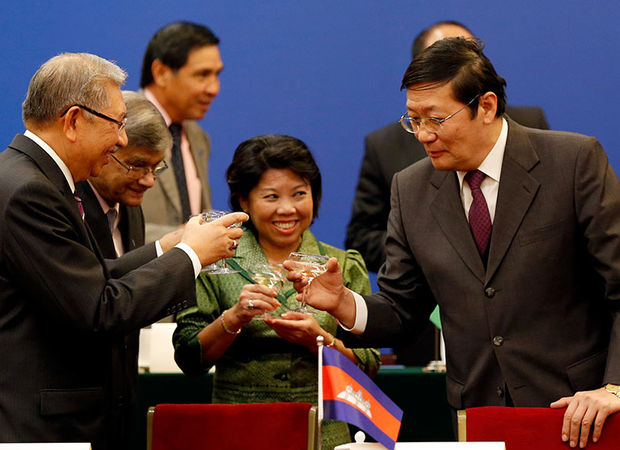

The incoming AIIB president, Jin Liqun, who served as a high-ranking official at both the World Bank and Asian Development Bank, has repeatedly stated that the AIIB will be “clean, lean, and green.” He has denied the idea that the bank could contribute to a “race to the bottom” among International Financial Institutions (IFIs) by cutting corners in terms of financial, social, or environmental standards.

A central question about what to expect from the AIIB in the future boils down to what to expect from China, which will hold a dominant position in the bank’s governance structure. As China-led institutions like the AIIB take on increased responsibility in the international system, Beijing will inevitably play a role in shaping and setting the standards that govern that system.

Conversation

03.24.15

What Went Wrong With U.S. Strategy on China’s New Bank and What Should Washington Do Now?

China’s own troubling human rights record—not to mention its general treatment of civil society, respect for the environment, and protection of worker’s rights—means there are good reasons to worry about how much the AIIB will concern itself about possible human rights risks associated with its investments.

The AIIB’s standard-setting process has been less than encouraging so far. Its draft “Environmental and Social Framework” (ESF), the key document articulating how the bank would “identify and manage environmental and social risks and impacts” of its operations, was lacking in many respects.

As Amnesty International pointed out in its detailed submission to the AIIB, the draft ESF made insufficient reference to existing human rights standards; had significant gaps in terms of policies related to resettlement, labor, and gender discrimination; failed to cover the situation of sub-contracted, third-party, and community labor workers; and made all-important gender impact assessments of its operations “desirable” rather than mandatory. Most worryingly, given the track record of many IFIs in the past, the draft failed to provide adequate guarantees on involuntary resettlement.

The NYRB China Archive

06.25.15

A Partnership with China to Avoid World War

from New York Review of BooksPerhaps even more revealing of the AIIB ethos at this point is the way the consultation was conducted: the public consultation was limited to a mere six-week period, conducted only in English, and conducted only through a series of video-conferences. It’s not clear how communities who might have wanted to participate but didn’t have English speakers or broadband Internet access were supposed to participate. NGO calls for making the process meaningful fell on deaf ears.

Such arrangements do little to dispel the impression that the AIIB viewed the process as little more than a formality, which in turn raises questions about how seriously the bank plans to undertake meaningful engagement with stakeholders, particularly those who are the most vulnerable and marginalized.

As the bank opens for business, the ESF has been finalized but members have yet to see it. Similarly, the disclosure policy and accountability mechanism procedures have been drafted, but no one has seen them.

Commitment to human rights is not just a matter of good policy; it is also a political commitment and legal obligation of all members of the AIIB, and of states in which AIIB projects are implemented. Individually and collectively, AIIB members have the duty to ensure that their decisions do not lead to human rights abuses. This duty is also reflected in the U.N. Guiding Principles on Business and Human Rights, which were adopted by the U.N. Human Rights Council in 2011.

Media

04.02.15

‘Obama Is Sitting Alone at a Bar Drinking a Consolation Beer’

There is certainly room for a China-led bank to play a larger role in international development, and the arrival of the AIIB presents an opportunity to build on past experience, improve upon the existing system, and set higher standards for multilateral development banks.

If this is going to happen, however, the process needs to begin now. Member countries must uphold their international law obligations and commit the AIIB to the highest standards of transparency, in order to minimize the risk of funding projects that may contribute to adverse human rights impacts.

Instead, respect for human rights can support sustainable, inclusive development in order to address inequality and entrenched discrimination, ensure that development outcomes reach the most marginalized members of society, and increase access to justice, strengthen civic participation, and enhance accountability.